There's a good chance that the wedding and reception you and your future spouse plan will be the most expensive event you've ever coordinated. Recent polls show that the typical cost of a wedding in the United States is over $20,000. Given the financial stakes, investing in wedding insurance could be a brilliant move. Nonetheless, before purchasing insurance, it is crucial to have a thorough understanding of what will and will not be covered.

What Is Insurance For A Wedding?

In the event of unforeseen situations, wedding insurance (also known as special event insurance) protects the policyholders financially.Insurance can protect your cash in several unforeseeable events, such as problems with suppliers, illness or accident, stormy weather, military deployment, missing or stolen gifts, and damages to wedding attire.

How Comprehensive Is Wedding-Day Coverage?

One couple's experience with wedding insurance before the big day. An unanticipated event derailed a 2010 formal wedding at the Kiawah Island Golf Resort near Charleston, South Carolina, that had been planned by a client of Dulles Designs, a printer of custom stationery and invitations. Emilie Dulles, owner of the Charleston-based design studio Dulles Designs, explains, "We had developed and letterpress-printed her exquisite wedding invites and are ready to hand-cancel and mail her calligraphy-addressed envelopes out to all invitees." The team finished the envelopes when they heard the news that the client's wedding location had caught fire.

Liability Insurance For A Wedding

Thus according to Berke, liabilities insurance is usually required by your location. It safeguards the venue and you from a variety of potential problems, such as:

- Cost to repair party-related damage to the venue

- wedding-related injuries

The damage and medical bills will likely be covered by liability insurance. Remember that your liability insurance policy probably only protects you for 24-48 hours after the reception breakdown ends. Although you might be able to get insurance for the rehearsal dinner, it's unlikely that any parties following the wedding would be covered. If you're doing your catering for the wedding, or if the venue or caterer doesn't provide it, you'll need host liquor liability insurance, which is typically included in these policies. You can avoid legal trouble with serving alcohol at your wedding by purchasing host liquor liability insurance.

How Does The Insurance For A Wedding Work?

When purchasing wedding insurance, you can select your coverage levels and deductibles. If something does happen, the cost of your policy, the types of expenses it will cover, and your out-of-pocket maximum will all depend on these.

Different Insurance Policies

You may be able to tailor your insurance policy to include varying levels of protection for various possessions from a variety of different providers. As an alternative, there is bundle coverage.

Coverage For Liability

Before spending money on wedding insurance, ensure the venue covers any potential liability issues. This would be an excellent layer of defense for the big day. If the location does not offer liability insurance, you may need to get your own. Coverage for wedding-related events may extend to injuries to guests or damage to property, or both. Depending on your location and your state's restrictions, host liquor liability insurance may also be a must. The policy protects you from legal repercussions stemming from alcohol use.

Cancellation Coverage

Having to delay or cancel your wedding for one of several frequent reasons might be financially devastating. Since most of them are already covered by wedding cancellation insurance, purchasing liability-only coverage may expose you in some situations; however, you may be able to add on additional coverage by purchasing riders.

Challenges with Suppliers (revoked permits, bankruptcy, or failures)

Sickness and injury among the populace

Any destruction to the property that would render the location unsuitable

Whether that is extremely rare or severe

Conducting Military Operations

Protection for damaged dresses or expensive wedding garb

Conclusion

Getting marriage insurance, which is part of the larger category of event insurance, can absolve you of any financial responsibility in the event of a loss associated with your big day. That's the only way to ensure you're completely debt-free. Unforeseen circumstances that result in damage or harm at a wedding, extreme weather, problems with the venue or vendors, and other unforeseen events could derail your wedding plans.

watch next

-

Buying and selling an investment often during a single trading day is known as "day trading." Foreseeing and taking advantage of even little price changes can result in substantial profits. However, it can be dangerous for novices or those who don't follow the rules.

Buying and selling an investment often during a single trading day is known as "day trading." Foreseeing and taking advantage of even little price changes can result in substantial profits. However, it can be dangerous for novices or those who don't follow the rules. -

What Is Insurance For A Wedding And Why You Need To Know

What Is Insurance For A Wedding And Why You Need To Know -

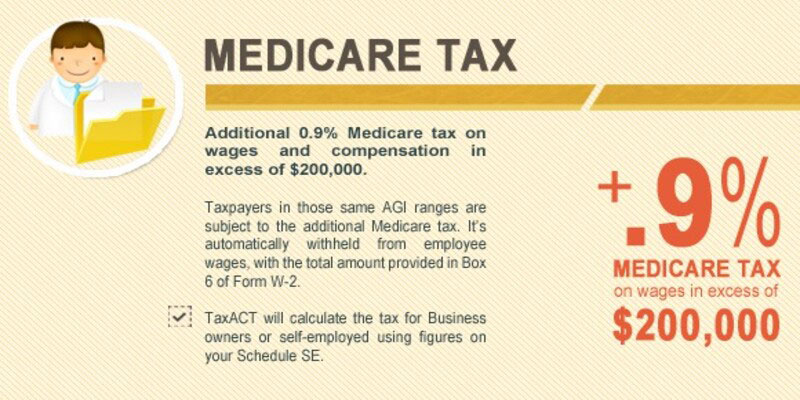

An In-Depth Look at Medicare Taxes: Paying for Senior Healthcare

An In-Depth Look at Medicare Taxes: Paying for Senior Healthcare