Medicare taxes were created to provide funding for the Medicare program and are an integral part of the American healthcare system. Medicare was established in 1965 to help seniors and people with disabilities with access to affordable health care. Individuals' wages are taxed to pay Medicare, making it a mandatory government program. Medicare taxes serve a dual function. First, they back Medicare's various components, which provide insurance for doctor visits, hospital stays, and other medical expenses. By collecting these fees, the government guarantees access to medical care for people of all income and job levels, including older people and people with disabilities. Second, Medicare taxes intend to encourage universal healthcare access, hopefully reducing the financial stress brought on by medical costs as people age and leading to a happier and more secure senior population.

Recognising Medicare Taxes' Intended Use

Assistance With The Medicare Programme

Finances for Medicare, including hospitalization provisions, medical services, prescription medicines, and more, are collected through the Medicare tax. By levying these charges, the government guarantees a reliable financial stream to maintain and grow the program, which provides vital medical care to older people and people with disabilities.

Guaranteeing Everyone's Right To Medical Care

Medicare's principal mission is to ensure that all seniors, regardless of their ability to pay or job status, have access to quality medical care. By funding a dependable and low-cost system to reduce the stress of paying for healthcare in old age, the taxes collected contribute to a more secure and healthy elderly population.

The Evolution Of Medicare Taxes Over Time

Passage Of The Changes To The Social Security Act

As part of his Great Society program, President Lyndon B. Johnson signed the Social Security Act Amendments in 1965, establishing Medicare. The Medicare program and its attendant tax provisions would not exist without this historic act.

Introduction Of Tax Rates For Medicare

At first, employers and employees were responsible for paying 0.7% of all income over a certain threshold. The rates have grown over time, and new taxes have been instituted to pay for the rising cost of medical care to an increasingly elderly population.

Increasing Medicare Tax Base

In 1993, the government began including a percentage of high-income earners' wages in the Medicare tax base. Incomes above specific criteria are subject to an extra 0.9% tax under the additional Medicare Tax implemented in 2013.

Tax Rates And Income Limits For Medicare

Hospital Insurance (Part A) Of Medicare

Contributions Made By The Employer And Employee

The current Medicare Part, A payroll deduction percentage for employees and businesses, is 1.45%. However, individuals with incomes over $200,000 and couples with incomes over $250,000 are subject to an additional 0.9% Medicare tax.

Medicare Part A Premiums

Part A of Medicare is typically provided at no cost to beneficiaries due to their employment records. Still, beneficiaries who do not have sufficient "work credits" may be compelled to pay premiums.

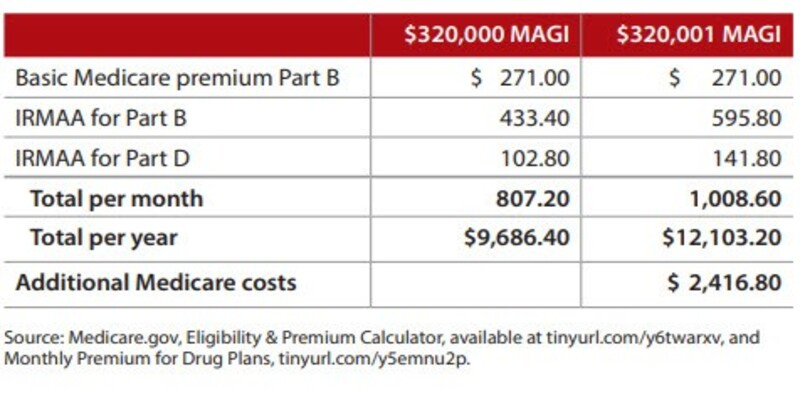

(Medical Insurance) And Part D (Prescription Drugs) Of Medicare

Financing Through Premiums

Beneficiary premiums and subsidies from the general tax revenue and Medicare taxes support Medicare Part B and Part D.

The Effects On Employees And Employers

The Job Of The Employee

A percentage of each paycheck goes to Medicare taxes, guaranteeing future healthcare coverage for employees. Salary, wage, and self-employment income are familiar sources from which these taxes are withheld, reducing net income.

Responsibilities Of Employers

Medicare taxes must be withheld from employee paychecks and remitted to the government, and this responsibility falls squarely on the shoulders of the employer. Employers genuinely caring about their staff should match their employees' healthcare contributions.

Self-Employed Individuals

Self-employed people must make employer and employee Medicare contributions. The self-employed individual must determine and pay both the employer and employee halves of the 2.9% Medicare tax due on self-employment income.

Conclusion

Medicare taxes are an essential source of revenue for the United States system of providing medical care for older people and people with disabilities. Because of these levies, the Medicare program can continue to offer seniors the medical coverage they need at an affordable cost. The government has attempted to deal with the changing healthcare requirements and rising expenditures of an aging population by gradually increasing Medicare tax rates and thresholds. Employers and workers feel the effects of Medicare taxes through wage withholding and subsequent government payments. However, Medicare's continuous effectiveness in providing universal healthcare access to seniors and the disabled requires ongoing examination and future modifications to address issues, including rising healthcare costs and long-term sustainability.

watch next

-

Everything You Need to Know About Financial Institutions

Everything You Need to Know About Financial Institutions -

Buying and selling an investment often during a single trading day is known as "day trading." Foreseeing and taking advantage of even little price changes can result in substantial profits. However, it can be dangerous for novices or those who don't follow the rules.

Buying and selling an investment often during a single trading day is known as "day trading." Foreseeing and taking advantage of even little price changes can result in substantial profits. However, it can be dangerous for novices or those who don't follow the rules. -

What are the Best Technology Jobs in 2023

What are the Best Technology Jobs in 2023