The ratio of a country's public debt to its gross domestic product is the statistic. This ratio is often represented as a percentage, but it may also be understood in terms of the number of years required to retire the Debt if the whole GDP is devoted to doing so.

The ratio of a country's total debt to its gross domestic product is an indicator of the health of the country's economy and the probability that it will be able to pay off its Debt. It is used to compare nations or to evaluate whether or not a country is likely to experience economic instability shortly. It is also a straightforward method of comparing a country's economic output (as measured by gross domestic product) to the amounts of Debt the nation carries. 1 In other words, this ratio provides analysts with information on the amount of money the nation makes annually and how that number compares to the amount that the nation owes. The amount of Debt is often presented as a proportion of GDP.

Debt-to-GDP formula

The information that you need to calculate the GDP of a nation may be obtained from a variety of different sources. For instance, you may utilize the Debt to the Penny website, which is maintained by the United States Treasury and provides an exhaustive accounting of how much money the country is in Debt.

How the Debt-to-GDP Ratio Works

Investors, political leaders, and economists may all benefit from understanding the debt-to-GDP ratio. It enables them to determine whether or not a nation can repay its debts. If a nation's debt-to-GDP ratio is high, such as 101 percent, it indicates that it is not creating enough money to pay down its Debt. A ratio of 100 percent implies that there is just enough production to pay debts. In contrast, a ratio lower than 100 percent shows sufficient economic output to make payments on obligations.

If a nation were a family, its GDP would be analogous to its income. If you have a higher income, the bank will be more willing to lend you a larger loan. In the same manner, investors will be more than eager to take on a nation's Debt if the country in question has a significantly greater level of economic activity. This is because investors perceive a higher danger of default. Because of this, the cost of the country's Debt will rise. A financial crisis occurs in an economy when the cost of Debt climbs to an unsustainable level.

Limitations of the Debt-to-GDP Ratio

You need to know two factors to calculate a debt-to-GDP ratio: the total amount of a country's Debt and its gross domestic product (GDP). This calculation seems to be very plain forward until you learn that there are two different ways that Debt may be quantified. The public Debt plus another category make up the total amount owed by the United States. According to the United States Department of the Treasury, the Debt that is held by the public is comprised of U.S. savings bonds and Treasury notes that are owned by individual individuals, corporations, and even governments in other countries. Some other owners of Public Debt in the United States are local governments, pension funds, and mutual funds.

Economic Growth Can Slow After a Certain Level

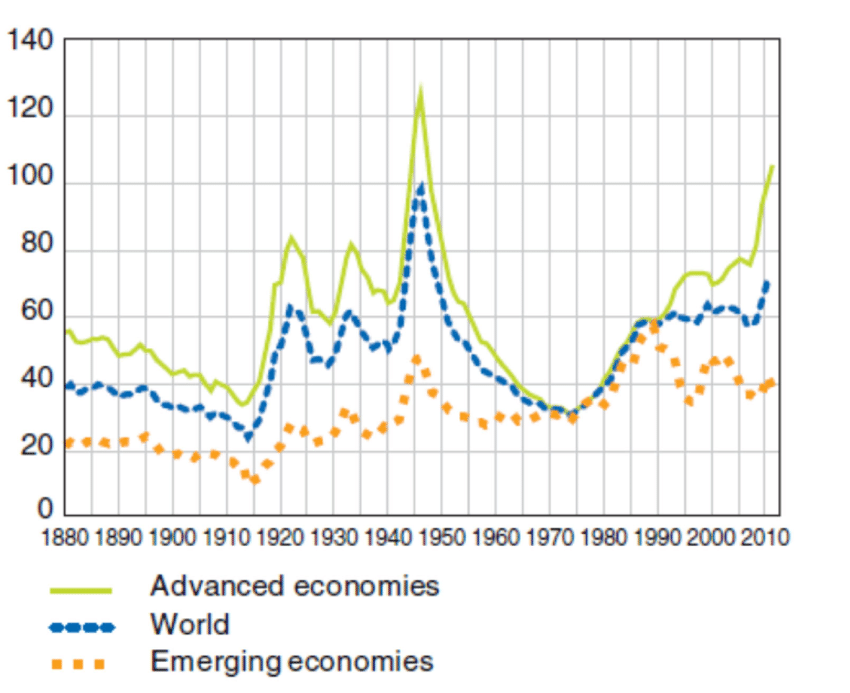

According to research published by the World Bank in 2013, a ratio of Debt to GDP that is more than 77 percent over a prolonged length of time is detrimental to the rate of economic growth.

Because every time there is a gain in production, that gain is diminished by Debt, and an economy is prevented from attaining its full output potential, which in turn prevents the economy from growing to its full potential.

Comparison Between Countries

The ratio of a country's Debt to its gross domestic product enables a comparison of the debt levels of different nations. For instance, while Germany's public Debt is far more than that of Greece, the country's gross domestic product in 2017 was $4.2 trillion, which was significantly higher than Greece's $299 billion. Compared to Greece's ratio of roughly 193 percent, Germany's debt-to-GDP was less than 64 percent. 910 During Greece's financial crisis, Germany was able to save the country.

It is not as simple as comparing one apple to another when attempting to evaluate a country's level of Debt about its GDP. The ratio is nevertheless a useful measure of how much Debt a nation takes on to remain productive, although there are many other variables to consider.

watch next